Helping our customers move forward with credit

We focus on being a responsible lender, ensuring the right outcomes for our customers. We understand our customers' needs and work proactively to provide them with tools to help stay in control of their finances. Treating our customers fairly, protecting their data and providing a level of care and service that is appropriate to each individual is at the centre of our customer-focused ethos.

2.4 m

customers improved their credit score

441 k

customers extended payment support

824 k

customers registered for our financial education tools and Credit Score (against a target of 770k)

c. 100+ k

vulnerable customers supported with tailored services

Responsible lending

We establish responsible and manageable credit limits that can evolve over time to suit people’s needs and ability to repay in a responsible and sustainable way.

Our in-house credit infrastructure enables us to react quickly to changes in performance and customer and retailer needs as well as the macroeconomic conditions around us. It’s also aligned with the latest regulatory requirements and good practice.

Supporting our customers

At NewDay, we understand the importance of ensuring customers receive the right service. We are proud that 2.4 million customers improved their credit score in 2023.

We understand that customers’ credit needs change over time and that sometimes this means they need additional support. We use early intervention tools to identify possible financial difficulties and engage vulnerable customers through a dedicated team.

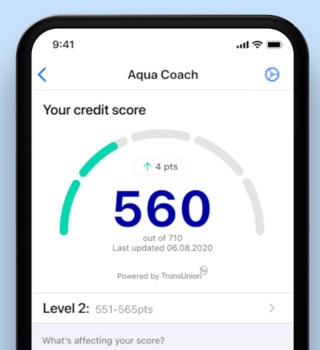

Aqua Coach

Our free-of-charge financial education tool, Aqua Coach, is designed to help customers improve their credit score and gain access to better financial products. As at December 2023, 824k customers have registered for Aqua Coach, or Credit Score on our other Direct to Consumer brands, with over 40% of customers actively checking their credit score and using the feature every month.

High quality customer service

As a responsible lender, our objective is to always do the right thing. We aim to treat customers fairly and ensure the products we offer meet their different credit needs.

Our dedicated customer complaints team aim to resolve issues in a responsible, timely manner. We measure customer satisfaction through feedback and surveys with findings being used to ensure the highest quality service is continuously delivered.